Here is some good news, Hubballi Airport will be privatized by the Financial year 2023-24 under the Asset Monetisation program. Hubballi is the only airport in Karnataka that has managed to secure its place for privatization.

Under Central Government’s National Monetisation Pipeline, 25 AAI-managed airports are considered for Asset Monetisation. The total value of assets considered for monetization is estimated to be ₹ 20,782 Crores for the FY 2022-25.

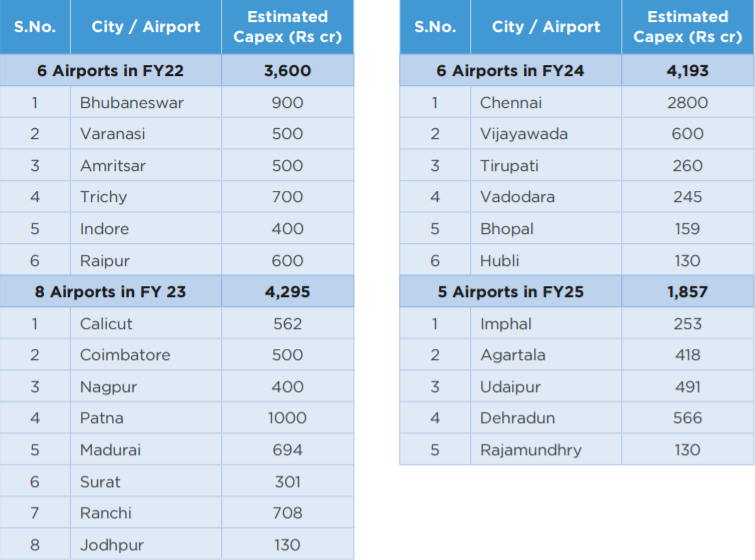

The 25 airports will be privatized in 4 phases: 6 airports in FY22, 8 in FY 23, 6 in FY24, and 5 airports in FY25. The details of selected airports are as follows:

Airport Monetisation through Brownfield PPP models has been boosted in India by the success stories of four airports i.e Mumbai, Delhi, Hyderabad, and Bengaluru. This is primarily in terms of improved user experience and an increase in value for all stakeholders.

During FY 2020-21, 6 AAI airports were leased out to the private sector through PPP-based model i.e Ahmedabad, Lucknow, Mangaluru, Guwahati, Jaipur, and Thiruvananthapuram.

India has immense potential to grow further and this calls for higher investment to build new airports and augment the existing Airport Infrastructure to support future growth.

India has seen massive growth in the airport sector with investments from both the Government and Private sectors. The country has become the third-largest domestic Civil Aviation market in the world.

Airport Authority of India(AAI) manages 137 airports including 24 International airports, 10 customs airports, and 103 domestic airports. In FY 2020, AAI airports handled ~160 million passengers (International: 22 million and Domestic: 138 million), which accounted for ~35% of the total passenger traffic handled by airports in India.

It may be noted that under PPP-based mechanisms, based on the final transaction structure for the projects, there could be additional revenue streams to AAI. AAI can generate revenue streams such as Passenger fees, upfront premiums, or any other charges.